The Possibilities for DeFi on EOS

The most exciting and bullish areas in the entire blockchain and cryptocurrency space at present seem to be in the areas of NFT’s/collectibles, games, and decentralised finance or DeFi. There are some obvious contenders from the EOSIO space for collectibles and gaming such as WAX.io, Ultra.io, and Telos that have been striving forth and setting the bar in many cases far beyond anyone else in the space, but one of the least mentioned blockchains talked about when the topic of DeFi comes up is EOS. Things however are starting to change, and even those on the inner Block One circle have been making a point mentioning future possibilities for DeFi on EOS in recent times.

Why then are people not using EOS when it comes to DeFi? Well, looks can be deceiving and there are in fact quite a few DeFi applications under way within the EOS sphere.

Oddly enough however, just about every well known DeFi project out there seems to be operating on Ethereum despite the crazy high fees that presently exist. That does not mean that options on EOS do not exist, it just means that the majority of people that are talking about DeFi are focused on primarily the Ethereum space. In part this may be because the Ethereum space has completely mooned, but what will happen then when people discover near feeless transactions and 0 lag time in the EOS space.

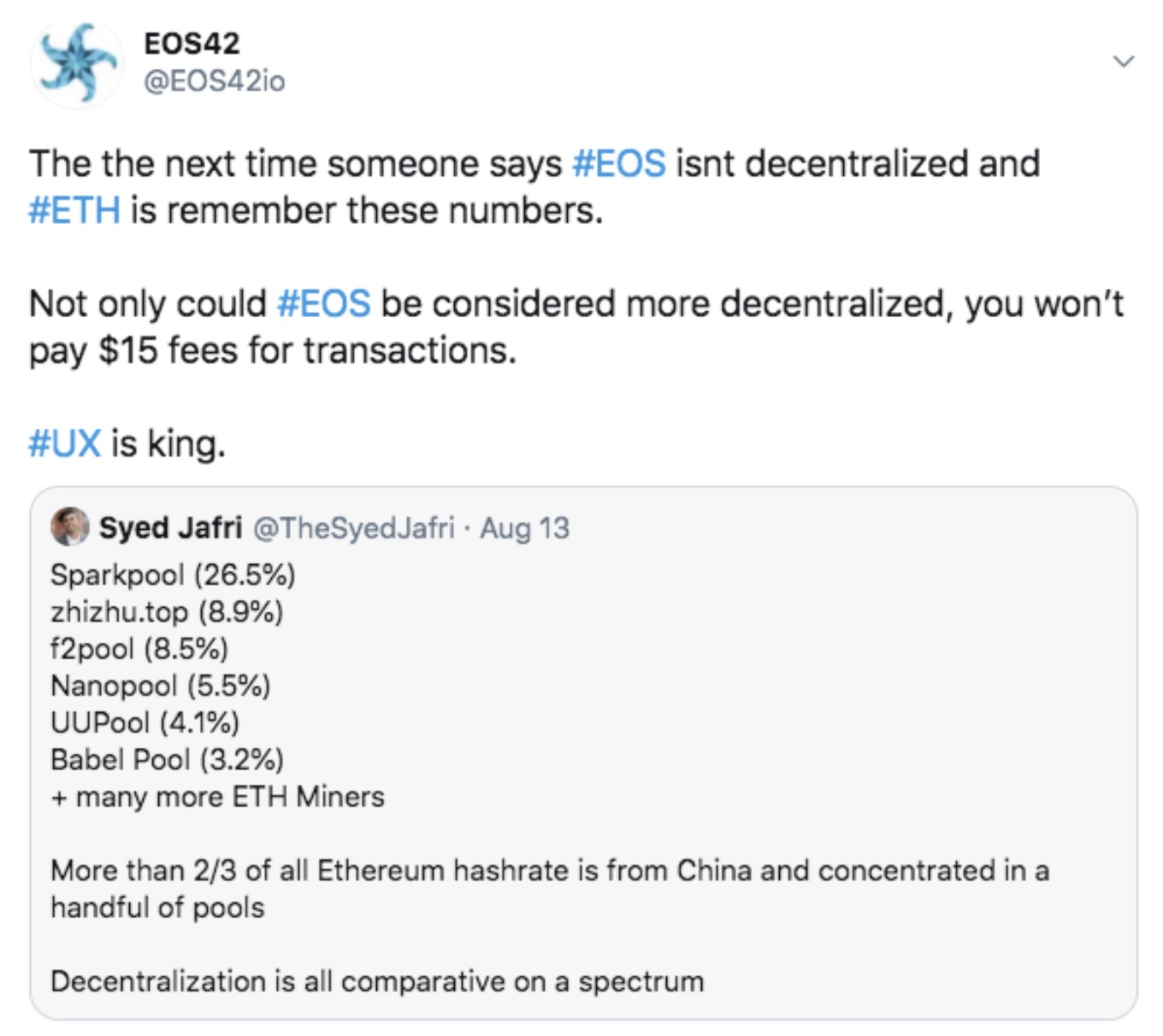

For some time now it has been pointed out by haters of the EOS space that it is too centralized. Ironically enough when you really look at it what you can see is quite the opposite.

And yes, there are issues in governance concerning collusion and the like, and not that they are not important but those stories are irrelevant here. It might be the case that many Ethereum and Bitcoin maximalists have bought into the narrative that EOS is too centralized, but with high fees for every singular transaction eventually it will be those that are looking for the best DeFi yielding opportunities that will jump the barriers and move towards EOS despite how the broader FUD community has primed them what to think.

But what options on EOS do in fact exist then and how do they compare to those on the Ethereum and other spaces? Well, here is a brief rundown on some of the operational projects and services provided for those willing to look beyond the FUD and into the EOS DeFi space seemingly growing more solid by the moment.

First things first, for those currently beyond the EOS space you will be required to set up an EOS wallet. The process is actually quite simple and the options are plentiful. If you’re really in a bind might we suggest going through the process to set-up Wombat (EOS Onboarding: Free Accounts) or Anchor (EOS Beginners: Anatomy of an EOS Account) which we introduced and outlined previously on EOS Go.

DeFi Options on EOS

DeFi can be broken into a few differing categorizations, and depending how deep and with what amount of risk one is preferential to, the projects which are most suited to your particular tastes will vary.

Likely the easiest and simplest to understand is the staking dynamic whereby assets are locked up and an APY is paid out as per the contractual terms and conditions. Although the most popular of these is REX, by no means is it any longer the only option.

EOS REX

At its core EOS REX is a lending and borrowing market for EOS resources. Those with EOS can lend out resources for others that may need them whether it be for personal or dApp provision purposes to utilize when in need. REX can be lent out (or rented) easily with a number of different block explorers such as EOSX or EOS Authority simply by logging in and allocating your resources to the pool. When these are claimed back you will receive the equivalent amount which were originally put in plus the interest earned.

Another option for leasing markets on EOS is Chintai. In a similar manner to what REX has done, Chintai has taken this idea a step further and essentially automated the entire process. Whereby for users of REX it is necessary for users to manage their own resources and risk potential outages an poor UX for resource providing dApps, Chintai provides Automated Resource Management registration options for CPU, NET, and RAM meaning those with EOS or CHARM tokens to lease out can benefit from the passive income opportunity.

In addition to this, Chintai also hosts and is in the process of building other specifically tailored DeFi products on the EOS blockchain such as Token Leasing helping with the robust formulation of markets helping other projects reduce overhead and reward token holders in the process. At present Chintai offers four token leasing and pool markets incorporating EOS, WAX, DAPP, and BOID tokens offering up the chance for passive income earning opportunities for token holders.

Equilibrium

Other projects working towards offering up valuable leasing markets in the EOS space are Equilibrium and Vigor both offering up their own unique brand of tokens to participate with.

Equilibrium users are able to stake EOS, EOSDT, and NUT tokens to get a passive income of up to 11% APY. However, Equilibrium continues to develop and will use Polkadot’s technology to enable the full potential of the DeFi market by vastly expanding its product line and cross-chain interoperability.

The team has announced a new utility token, “EQ”, which is required to accommodate the added functionalities that come with their new products on Polkadot. With it, users can do much more than before. The value of the new EQ utility token is an expansion of the product line that adds cross-chain interoperability and promises to exponentially boost Equilibrium’s value for users and DeFi overall. The token swap is underway and began on August 31st allowing users the ability to exchange the EOS-based utility token NUT for the new cross-chain-enabled EQ tokens. The rate will gradually increase during the swap and will end after 30 days.

Equilibrium also has plans to introduce pooled lending and a new USD-pegged stablecoin with cross-chain functionality. These products will utilize assets from various cryptocurrency types beyond that of just EOS or BTC across multiple blockchains for users to take out loans against.

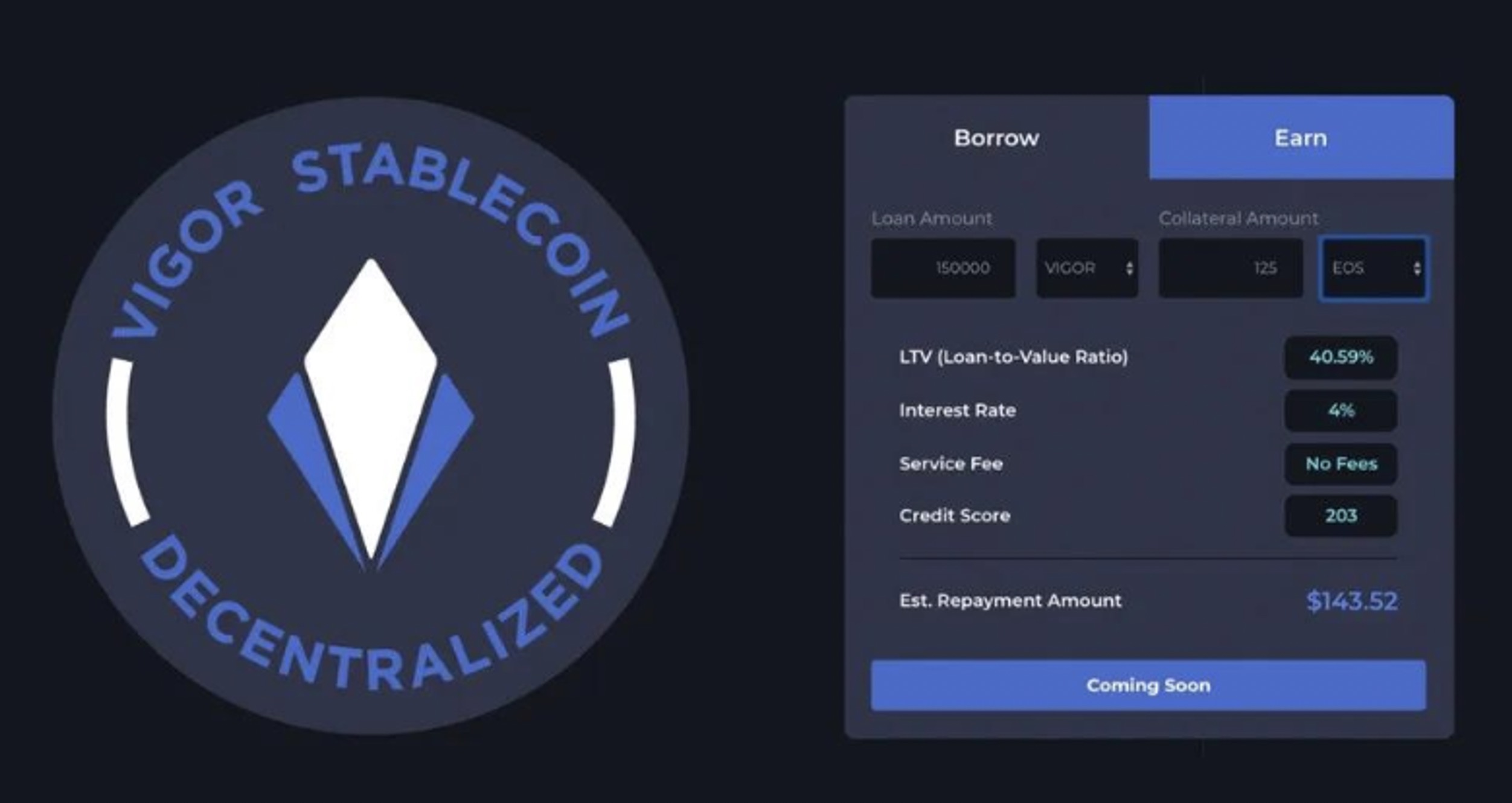

VIGOR

The VIGOR Protocol offers users the ability to lend, borrow, and save the native platform utility token VIG, the low volatility token VIGOR, and EOS all directly within the easy Vigor App interface. With a clean interface and some of the most impressive statistics we have ever seen from any DeFi app on the market, VIGOR shows real promise in the space. The rates are dynamic and reflected in real time based on a complex algorithm taking into account a variety of simultaneous factors. Unlike other DeFi platforms in the space, utilization of the Vigor App offers the ability to compile a basket of collateral to back a loan and when bailouts are triggered, there are no additional fees taken beyond that of the loss of collateralized assets which are distributed proportionally alongside bailout debt to insurers within the platform.

Another very unique thing about Vigor is the decentralized nature of the entire project being built from the ground up via contributions of community members within the Vigor DAC. At present in fact the platform is only open to DAC members, but plans on an official soft launch whereby the gates will be opened up to a broader audience over time for all those of interest to begin utilizing the services the Vigor App provides. In the meantime, should you wish to try your hand at what the Vigor Protocol offers with borrowing, lending, and insurance for supported tokens, it’s possible to become a DAC member and gain early access via the staking of 10,000 VIG tokens into the app.

Of course no DeFi conglomerate would be complete without taking into account liquidity pool and swap options, of which quite a few are present. That said the one to have really raised the bar over the past recent history of DeFi liquidity pool provision and swapping is xNation which operates in tandem with the Bancor Network’s BNT token for EOS based pooling pairings. By utilizing the xNation platform, users can add to BNT based liquidity pools on EOS as well as to ETH and USD based pools that help to provide swapping options for token holders in general markets mitigating slippage along the way.

Defibox

The new kids on the block when it comes to EOS DeFi and liquidity provision are Defibox, Pizza, and DeFis Network. These platforms essentially allow for mining provisions within their platform activities which mint tokens that can be used for a plethora of things from participating in liquidity pools to swapping, and even towards platform governance.

Defibox touts itself as the one-stop DeFi application platform on EOS and one of the first to receive funding and support from the Newdex DeFi initiative. At present Defibox has launched two primary protocols, Swap and the former Danchor project USN stablecoin. Plans for launching more revolving around such themes as decentralized lending and synthetic assets are currently in the works with the goal of rounding out the DeFi protocol matrix tailored towards one-stop DeFi app platform ambitions and status.

The completely decentralised Swap protocol on Defibox is a completely decentralized token swap and automatic market-making protocol (AMM) providing real time swap prices and instant user swap functionality. As part of this protocol, users can easily create their own or join a swap market providing liquidity for two tokens in direct proportion earning automatic fees based on liquidity ratio paid from every transaction to the market makers. The mining fees which are earned are generated in BOX tokens at various weights depending upon the action or tokens involved.

The USN stablecoin is generated via staking EOS and is pegged 1:1 to the U.S. dollar. “The system adopts the risk control mechanism of over-staking and liquidation to avoid market fluctuations and provide value support for each USN with sufficient staking items.” source

The BOX DAO allows BOX holders voting rights decision making capabilities towards defining important parameters of each DeFi protocol such as which tokens are listed, which tokens pay dividends, Swap protocol transaction fees, BOX mining weight for each token liquidity pairing generates, and USN stable coin treasury interest and liquidation penalties. The Defibox Foundation reasons that due to the fact that BOX holders hold these rights regarding decision making parameters that BOX holders in turn will benefit directly from the government aspects of the protocols which they help to implement and maintain.

Although this all might sound rather confusing, it’s really quite a clean and easy to understand platform and interface as can be seen in the very comprehensive article complete with video references, Introducing Defibox: An All In One DeFi Application Built on EOS.

PIZZA

Pizza is an EOS based two-token stablecoin system issuing USDE by collateralizing various crypto assets with excess collateral and deploying via smart contract a 1:1 stablecoin to USD pegged USDE token. Pizza also allows users to add to various supported EOS based liquidity pools providing liquidity for onsite swap functionality, deposit and borrow within the Pizza Lend platform application, and utilize the Pizza DEX, a native decentralized financial exchange on the Pizza financial network.

DeFis Network

DeFis Network is a multi financial framework network purporting to offer up a solution from the mainstream isolated and fragmented current one. Based on blockchain technology, DeFis Network utilizes the DFS token for trading, community, governance, liquidity incentives, dividends of protocol fees, staking, and issuing and generating assets. The project is looking to create and maintain a series of financial instruments over time to help achieve their goal. At present staking, swap, pools, and banking functions are operational with lending and synthetix opportunities listed as coming soon.

No matter how you dice it, it is undeniable that options are abound within the EOS space when it comes to DeFi development and incorporation. Take PredIQt for example, the Everipedia team's 2nd dApp and soon-to-be full DeFi platform offering full prediction market functionality with even more features than platforms like Augur currently offer. With PredIQt users can create, participate, and resolve markets, all of which are powered by the IQ token.

Of course this is just a small smattering of some of the more popular projects that are dropping a toe in the ocean of DeFi on EOS that is surely to come. And of course it is not that there are not other platforms and protocols out there that don’t deserve to be mentioned, but the fact remains that it’s so early here in the EOS DeFi space and even without such incentives such as the ‘Newdex Seed initiative used for incubation and developer support of ecological DeFi projects helping to promote prosperity of EOS ecology’, it would be impossible to cover every project that is presently looking at unique ways to broach into the EOS DeFi ecosystem.

The Future of DeFi on EOS

It should by now be clear that there are present plenty of opportunities available for those wishing to engage in EOS based DeFi. In one way one could even go as far to say that EOS has the potential to be the go to for DeFi across all chains.

As bullish as this may sound however, let us not forget that there are some issues that need to be worked out before users will flock to EOS enmasse.

For instance, due to such a small amount of projects operational in the EOS space, and such a small number of EOS token listings on centralized exchanges, the liquidity within the EOS space is a problem. That is not to say that it won’t find a balance and work itself out over time, but the fact remains that that balance will need time to be achieved. Already the gatekeepers are open and an influx of USDT has been flooding into the market, but just how long this will affect the overall growth of the space is yet to be determined.

Additionally, although there are possibilities for wrapped BTC and ETH on EOS already, the majority of DeFi platforms do not accept these versions of the tokens. For DeFi to really take off in EOS, more projects and protocols need to have the ability to intercept and ingest standardized tokens from beyond the EOS space and in the process become more dynamic in their ability to allow people to play in the EOS DeFi playground as naturally and at home as they would be within their own networks of origin - something more than possible with recent IBC and EVM advancements by those within the EOS space.

And on that note, likely the most serious barrier to entry for people beyond the EOS ecosystem is the basic act of creating an EOS account. Chalk it up to whatever you may, and in some cases down to complete FUD against principles that hold zero relevance beyond a narrative told by those believing more in the chains that came before, but in any case, many are still not willing to take the time learn how to create an account despite its relative ease, nevermind look past the fallacy that a 1 time fee or minimal resource rental fee is far superior to the much more expensive single transaction costs on other networks. This hurdle however may take a little more patience and time to overcome, and in all likelihood sooner or later people will realize the financial benefits of zero fees and instantaneous transactions which DeFi projects on EOS provide and reconcile that projects such as those above are not only worthy of exploration, but maybe best optimize the benefits of what DeFi could and should be.