Is Block.one's House of Blocks Crumbling?

In the cryptocurrency industry a lot can change in the span of a few months. We’ve seen bull markets turn bearish in a single weekend of trading. Large fortunes lost just as quickly as they were gained. Navigating the cryptocurrency space is certainly not for the faint hearted; the environment is harsh, with many people trying to separate you from the little that you have until you’re sent packing back to reality.

With all the scams, rug pulls, hacks, and other risks associated with self-custody, crypto can be an unforgiving place to be. Which is why those who are found to be acting maliciously, especially to the detriment of others, are ostracized from the community. We’ve seen plenty of examples of this, more recently with the FTX, Luna, and Celsius sagas, to name a couple.

FTX founder, Sam Bankman-Fried, is facing criminal charges. So are the Luna and Celsius founders, Do Kwon and Alex Mashinsky. The founders of these three companies are each charged with defrauding customers and investors out of billions of dollars. And that’s only one charge out of the multiple charges brought against each of them. The collapse or failure of these three companies, which were considered giants of crypto, all occurred during the year 2022. It’s now the second half of 2023 and the cryptocurrency industry is yet to recover from the billions of dollars that were essentially rugged from the crypto market.

Retrospect

Tracking back to 2017. The cryptocurrency industry was going through what was arguably its best period in terms of the number of new participants and investments entering its market. In 2017, the cryptocurrency market was at the peak of its bull cycle. Its parabolic run attracted a lot of attention from mainstream media, personalities, and investors. There were hundreds of Initial Coin Offerings (ICOs) being launched each day with promises to make investors rich, but none came close to the EOS ICO.

A company called Block.one, founded in 2016 by Brendan Blumer, Daniel Larimer, and Brock Pierce, ran, by far, the biggest ICO this industry has ever seen. The company came with bold statements, global marketing campaigns, and a bigger budget than all the other companies running ICO’s at the time. When it was all said and done the company had raised over $4 billion in the span of a year.

[*EOS AD in Time Square, New York*]

This crypto frenzy was most famously covered by HBO on Last Week Tonight with John Oliver in which there’s a segment where the host question’s EOS’ massive ICO and the associates of the company behind it, including Brock Pierce. Block.one’s operations and dealings with the EOS network following its launch have since proved pundits right in their assessments and skepticism of EOS.

Following the completion of the ICO, at a peak price of $21.64, and the mainnet launch of the EOS blockchain, the EOS marketing campaigns by Block.one ceased. Shortly after that, coupled with the start of a bear market, EOS’ token price began to drop. Along with a drop in community membership as many felt Block.one wasn’t holding up to its end of the bargain.

Things compounded over the years, with Block.one making excuses and kicking the can down the road. Eventually, just like everyone who acts maliciously to the detriment of others in this space, EOS was ostracized by the crypto community due to its association with Block.one. This was evidenced by the lack of positive media coverage of EOS, and the vast amounts of “hit pieces”/negative articles that would be published instead.

Finally, the EOS community had run out of patience with Block.one and its long list of assurances that amounted to nothing, and decided to take control of the EOS network and its Intellectual Property (IP). This, perhaps, was the final sign that Block.one may no longer have a sustainable future within the blockchain and cryptocurrency industry. The company did try to make one last attempt at having some kind of control over the EOS network, but when that failed steerers of the attempt diverged to other networks.

A troubling track record

Washtrading controversy

Block.one’s controversies don’t start nor end with the EOS network. In September 2021, Integra FEC, an analytics firm, published a report that alleged that 21 crypto accounts were used for washtrading purposes during the EOS ICO - to pump the price of the EOS token to unwarranted amounts.

The report alleged that these 21 accounts belonged to “closely connected associates” as each of the accounts’ trades during the ICO were for a minimum of $15 million respectively, and each account sold EOS tokens (($815 million worth collectively) for ETH on exchanges at an average loss of 1.4%. These trades would make it seem like there was more demand for the EOS ICO than there really was, resulting in the ICO fundraising over $4.1 billion. Funds that would later help fund Block.one’s multi-billion-dollar exchange, Bullish.

Pump and Dump scheme

A couple months later, in a report conducted and published by Ningi Research on March 3, 2022, it was revealed that Northern Data AG, a company that Block.one was closely associated with, went through a “concealed insolvency” after it had defrauded investors by pumping and dumping its company stock.

The report states that Northern Data AG and its associates, including Brendan Blumer, used acquisitions and exclusive capital increases to enrich themselves of more than €900 million. The company is said to have used affiliates and related companies, aggressive revenue accounting, forged financial statements, concealed related-party transactions and hidden shareholder structures, as well as excessive ad-hoc communication in order to pump and dump the company’s stock.

Other instances

There are so many other questionable operations that Block.one and its associates have conducted since the company was established in 2016. Some of which include the $24 million settlement with the SEC following a claim that it had sold “unregistered securities” in 2017 ICO.

Then there’s the ongoing class action lawsuit between EOS ICO participants (EOS investors) and Block.one. Previously a $27.5 million settlement offered by Block.one in the lawsuit was rejected by a New York judge. The case is awaiting a settlement hearing on September 19, 2023.

Of course, not to forget the many other instances where Block.one had been less than honest with the EOS community about its intentions to support and help develop the EOS ecosystem.

Righting wrongs?… Not at all

Block.one has missed many opportunities for atonement over the last five years since EOS launched, despite the constant requests by the community, and the resulting assurances from the company. Which is what had led to the company being booted out of the EOS network after it had neglected its responsibility in monitoring and updating EOS’ underlying code (EOSIO) repository.

Instead, in early December, 2021, Block.one tried to divest large amounts (45 million) of EOS tokens to its co-founder and associate Brock Pierce’s project, Helios. That transaction was freezed by Block Producers on the network after it had been established that the tokens were still vesting and didn’t belong to Block.one.

While Block.one was looking for ways to divest its EOS tokens and its role in the EOS network, the community was trying to retrieve some of the EOS IP from the company. Block.one basically refused to handover the IP, which includes the eos.io website and other related IP and materials, claiming that it now belonged to its subsidiary company, Bullish.

“Block.one knowingly misrepresented their capabilities, and this amounts to negligence and fraud.” - Yves La Rose (ENF founder and CEO)

Block.one failed to deliver on its promise to invest $1 billion into the EOS ecosystem, failed to maintain and improve the EOSIO code repository, refused to give the community what should be its IP, and finally, tried, by various means, to distance itself from the EOS network.

As a company, Block.one has failed with the EOS network, failed with its attempt at decentralized social media (Voice), saw its SPAC merger deal for Bullish fail to get SEC approval last year, and now Bullish, Block.one’s multi-billion dollar exchange, seems to be having a difficult time taking off.

EOS Community Lawsuit

Reasons

In a move to try and hold Block.one accountable to its commitment to invest $1 billion into the EOS ecosystem, the EOS community, led by the EOS Network Foundation (ENF), is taking steps on filing a lawsuit against the company. In an open letter published last month by the CEO of the ENF, Yves La Rose, he states:

“EOS Network remains the most compelling utility token network in the crypto space. Taking steps to hold B1 to its promises of investment in EOS Network will only improve EOS Network’s position and the long term value that [the] EOS Network can bring to its participants.”

As mentioned earlier, there is already an ongoing class action lawsuit by investors who participated in the EOS ICO and were “damaged” by Block.one’s actions, or lack thereof, which resulted in the token price plummeting. This new lawsuit by the EOS community isn’t related to the ongoing one; this new lawsuit would strictly be about holding Block.one accountable for its promise to invest $1 billion to the EOS ecosystem.

Impact

This lawsuit seems to have shaken Block.one, and perhaps even its investors. Just a few days ago, Samara Asset Group (formerly, Cryptology) announced that it had sold its entire stake in Block.one for approximately $119 million. This sale in particular should raise a big red flag to all Block.one investors and potential investors.

As we covered in an article looking into Block.one’s controversial business dealings, Cryptology, now called Samara Asset Group, is run by individuals who have closely been associated with Block.one CEO, Brendan Blumer, in other controversial dealings. Our last coverage of this particular company revealed that Samara AG (Cryptology AG) had a 4.9% stake in Block.one when they bought additional shares in the company in 2021 for $49 million.

Considering how close the people behind Samara AG are to Brendan Blumer, and previous allegations of them being involved in fraudulent activities and pump and dump schemes, this would likely suggest trouble is on the horizon. Is it possible that this foreshadows the crumbling of Block.one’s house of blocks? These people have already proved to have a knack of getting paid right when everyone is about to lose.

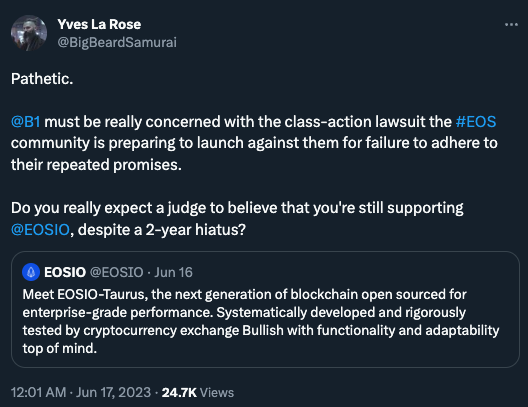

Meanwhile, also a few days ago, after roughly two years of not maintaining the EOSIO codebase, Block.one has come out with an announcement of a “next generation version” of EOSIO. The EOSIO announcement has been met with disparage and ridicule from most of the community. To come out with this announcement now after Block.one lied by saying Bullish would run transactions on the EOS blockchain, and their failure to maintain the codebase in roughly two years, seems suspicious at the least.

The fact that they’ve picked up on “improving” the codebase just as the community is rallying for a lawsuit against them, makes it seem like Block.one is trying to safeguard itself from legal repercussions.

To conclude,

With all the controversies surrounding Block.one and its business operations, it seems the company’s house of blocks is not at all concrete and has been exposed for being made up of plastic lego blocks. Block.one may soon be forced to close up shop as its public image has all but been shattered, with the EOS community’s sheer determination set to knock it over.

At this point it looks like things are only going to get worse for Block.one, its associates, and investors. What remains to be seen is whether it will finally give in and atone for the damage it has caused, or if it will try to fight and withstand the pressures mounting against them.

Greater giants have fallen in crypto before as we’ve recently seen with the collapses of FTX, Luna, and Celsius, etc. Does Block.one have the resources to mount a defense, and if it does, will investors stick around to see whether or not the company crumbles? Either way, the next couple of months will prove extremely tough for Block.one.

Sources

● Block.one wash trading? New report puts EOS developer in more jeopardy over controversial ICO

● Block.one’s Controversial Business Dealings

● EOS Was the World’s Most Hyped Blockchain. Its Fans Want It Back

Suggested News

Block.One is Launching Their First Indian EOS VC Fund

Brendan Blumer announced on Twitter, that soon Block.One will release a new EOS VC Fund focused on the Indian market, s...

This Week: EOS Developments Attract Mainstream Media Coverage

It’s been a busy week in the media for EOS, despite the fact that the vast majority of the crypto space was busy focuse...